Market Value and Appraised Value in Real Estate

What Is the Difference Between Market Value vs Appraised Value?

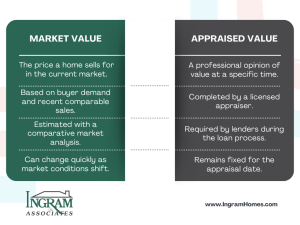

When comparing market value and appraised value, it helps to understand how each is defined. The appraised value of a house is a certified appraiser’s opinion of a home’s worth at a specific point in time. Lenders require appraisals during the loan process, and fees usually range from $200 to $300.

In contrast, market value refers to the price a home brings in the open market at a given moment. A comparative market analysis provides an informal estimate of market value, and a real estate agent or broker prepares this analysis using recent comparable sales.

Ultimately, when evaluating market value and appraised value, either an appraisal or a comparative market analysis offers one of the most reliable ways to estimate what your home is worth.

What Is a House Worth?

A home is worth the amount a buyer is willing to pay. However, when discussing market value and appraised value, both serve as structured ways to estimate that price.

Most homeowners rely on either an appraisal or a comparative market analysis. An appraisal provides a certified estimate of value at a specific time, and appraisers consider square footage, construction quality, design, floor plan, neighborhood access, transportation, shopping, and schools. In addition, they review lot size, topography, view, and landscaping. Most appraisals cost around $300.

Meanwhile, a comparative market analysis offers an informal estimate of market value, based on recent sales of similar homes nearby. Most agents provide this service for free in hopes of earning your business.

You can also review recent sales independently. For example, public records, assessor offices, private data companies, and online real estate sites provide access to comparable sales information.

How Is a Home’s Value Determined?

There are several ways to determine value. First, an appraisal delivers a professional estimate of market value, based on recent comparable sales, location, square footage, and construction quality. On average, an appraisal costs about $300 for a $250,000 home.

Second, a comparative market analysis estimates market value using similar sales and property features. Because agents analyze local trends regularly, they often provide this service at no cost.

Therefore, when analyzing market value and appraised value, both methods rely on comparable data, although one is formal and lender required while the other is informal and marketing driven.

What standards do appraisers use to estimate value?

Appraisers rely on multiple factors when estimating value.

These include home size, square footage, condition, neighborhood quality, and recent local sales. They also review historical data, sales trends, and market indices projecting future value.

For detailed appraisal standards, contact the Appraisal Institute. Their office is located at 200 W. Madison, Suite 1500, Chicago, IL 60606. Phone support is available at 888 7JOINAI during business hours.