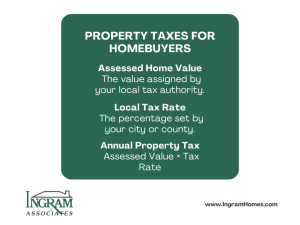

Property Taxes for Homebuyers

How Property Taxes for Homebuyers Work

Property taxes for homebuyers are annual taxes local governments charge property owners. Most counties calculate property taxes using a percentage of the home’s current market value. On average, homeowners pay around 1.5 percent of the property’s value each year.

Local authorities set tax rates and apply formulas to determine what homeowners owe. Because counties use these funds to support schools, roads, and emergency services, buyers should review local tax rates before purchasing.

Are Property Taxes for Homebuyers Deductible?

Many buyers ask whether they can deduct property taxes for homebuyers. In most cases, you can deduct property taxes if you itemize your deductions on your federal tax return.

You may also deduct mortgage interest and property taxes on a second home if you qualify. However, tax laws change, so consult a qualified tax professional to confirm how deductions apply to you.

What Is an Impound Account?

When you review property taxes for homebuyers, you will likely encounter the term impound account. Lenders create impound accounts, also known as escrow accounts, to collect funds for taxes and insurance.

Each month, you pay a portion of your estimated annual taxes and insurance into this account. Then your lender pays those bills when they come due. As a result, you spread property tax payments across the year instead of paying them in one lump sum.

Do All Loans Require Impound Accounts?

Not all lenders require impound accounts. FHA and VA lenders often require them. Many conventional lenders do not.

Because each lender sets different requirements, ask your loan officer how they will handle property taxes for homebuyers before closing.

How to Appeal a Property Tax Assessment

If you believe your local authority overvalued your home, contact the tax assessor’s office directly. Ask for the appeal procedure and review your assessed value carefully.

In some cases, staff may resolve the issue informally. However, most homeowners must file a formal appeal with the assessment appeals board. Since assessed value determines property taxes for homebuyers, correcting errors can lower your tax bill.

How Is a Home’s Value Determined for Tax Purposes?

County assessors determine home value using recent comparable sales, location, square footage, and construction quality. In addition, they review neighborhood trends and property characteristics.

Appraisers provide independent market value estimates when lenders require them. On average, appraisers charge about $300 for a $250,000 home.

Real estate agents also prepare comparative market analyses to estimate value based on similar homes. Buyers can use these reports to evaluate whether a tax assessment appears reasonable.

Why Property Taxes for Homebuyers Matter Before You Buy

Before you purchase a home, calculate the annual property taxes and include them in your monthly housing budget. Because tax rates vary by location, similar homes can carry very different tax burdens.

In addition, rising property values often increase future tax bills. Therefore, reviewing property taxes for homebuyers early helps you avoid surprises after closing.