Selling Your Home – Property Taxes

Understanding Property Taxes When Selling

Property taxes when selling can influence buyer affordability and pricing strategy. Therefore, before listing your home, review how your local government calculates property taxes.

Counties assess property taxes based on the home’s market value. In many areas, homeowners pay about 1.5 percent of the property’s assessed value each year. Local governments use this revenue to fund schools, infrastructure, and public safety services.

Because tax obligations affect monthly costs for buyers, property taxes when selling should be reviewed carefully before entering the market.

How to Appeal a Property Tax Assessment

If you believe your property has been overvalued, contact your local tax assessor’s office immediately. Ask about required documentation and deadlines.

In some situations, officials may review the assessment informally. However, most areas require a formal appeal filed with an assessment appeals board.

Since property taxes when selling affect buyer perception and affordability calculations, correcting an inaccurate valuation can strengthen your position.

External link suggestion

Link to your local county tax assessor website

Anchor text: local tax assessor’s office

How Home Value Is Determined

Property taxes when selling depend on assessed value, so understanding valuation methods is important.

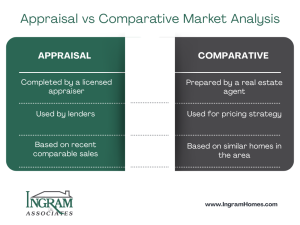

Appraisers determine market value by analyzing recent comparable sales, square footage, construction quality, and location. On average, an appraisal costs about $300 for a $250,000 home.

Real estate agents also prepare comparative market analyses. These reports estimate value using similar properties in your area. Most agents provide this service when you prepare to list.

In addition, private data companies and online platforms provide comparable sales information.

Are Property Taxes Deductible?

Many sellers ask whether property taxes when selling are deductible. In general, property taxes imposed by state and local governments are deductible if you itemize deductions on your federal tax return.

Mortgage interest and property taxes on a second home may also qualify. However, tax regulations change frequently. Therefore, consult a licensed tax professional before making decisions.

IRS guidance on property tax deductions

https://www.irs.gov/taxtopics/tc503

What Is an Impound Account?

An impound account, also known as an escrow account, allows lenders to collect funds for property taxes and insurance each month.

Instead of paying taxes in a lump sum, homeowners contribute a portion monthly. Then the lender pays the tax bill when it becomes due.

Although impound accounts primarily affect buyers, they may influence closing negotiations. Therefore, understanding property taxes when selling includes reviewing how existing loan terms handle tax payments.

Final Thoughts

Property taxes when selling influence pricing decisions, buyer affordability, and overall market positioning. Therefore, verify your assessment, understand valuation methods, and review deduction rules before listing your property.

If you need help setting a competitive price, review our guide on how to price your home to sell.

Internal link anchor suggestion:

how to price your home to sell