Selling Your Home – Seller Financing

What Is Seller Financing?

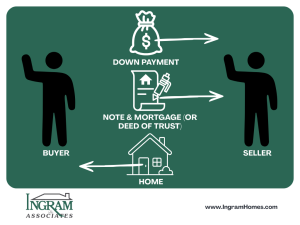

Seller financing allows a homeowner to help fund a real estate sale instead of relying entirely on a bank. In this arrangement, the seller extends credit to the buyer and receives payments over time.

In many cases, the seller carries a second note. However, if the property is owned free and clear, the seller may finance the full purchase price. Buyers often request this structure when they struggle to qualify for traditional lending or need more flexible terms.

Instead of providing cash like a bank, the seller applies a credit toward the purchase price. The buyer signs a promissory note and trust deed agreeing to repay the balance. If a first mortgage exists, the primary lender must approve the arrangement. Title or escrow companies prepare the final paperwork once both parties agree to the terms.

How Interest Rates Are Determined

Interest rates in an owner financed agreement are negotiable. Therefore, both parties should review current market conditions before finalizing terms.

Ask your agent to check prevailing mortgage rates through a lender or broker. Because sellers typically do not charge loan points, this structure may cost less than institutional financing.

However, economic factors still matter. Treasury yields and certificate of deposit returns influence expectations. Most sellers want a return comparable to what they could earn elsewhere.

As a result, the final rate reflects negotiation, risk, and broader market trends.

Benefits for Home Sellers

This type of transaction can expand your pool of potential buyers. It may also help close deals more quickly when conventional financing becomes a barrier.

Possible advantages include:

• Attracting buyers who cannot qualify traditionally

• Creating steady income through interest payments

• Increasing flexibility in negotiations

• Potentially supporting a higher sale price

Nevertheless, you assume lender risk. Therefore, you must evaluate the buyer carefully before proceeding.

Risks and Protections to Consider

When you finance a sale, you take on responsibilities similar to a bank. Because of that, due diligence is critical.

Before agreeing to terms:

• Run a full credit check

• Verify income and employment

• Require hazard insurance

• Include a due on sale clause

• Define repayment terms clearly

In addition, disclosure requirements and lending regulations may apply. For legal protection, consult a qualified real estate attorney before completing the agreement.

For tax considerations related to installment sales, review IRS Publication 537 on installment sales.

https://www.irs.gov/forms-pubs/about-publication-537

Is This Structure Right for You?

This approach works best in specific situations. For example, it helps when a buyer shows financial strength but cannot meet strict underwriting standards.

At the same time, sellers who own their property outright have greater flexibility. If you still carry a mortgage, confirm that your lender permits secondary financing before proceeding.

If you are evaluating different selling strategies, you may also want to review our guide on how to price your home to sell.

Read how to price your home to sell Here

Final Thoughts

Seller financing provides flexibility and can help complete transactions that might otherwise fail. However, it requires careful screening, clear documentation, and professional guidance.

When structured properly, this method can serve both parties while protecting the seller’s financial interests.